App Store Connect Help

App Store Connect Reference Reporting Transaction tax report fields

Transaction tax report fields

The transaction tax report is a monthly report summarizing sales tax, use tax, goods and services tax and other similar taxes applied on transactions in the US and Canada. The table below shows columns for the Transaction tax report.

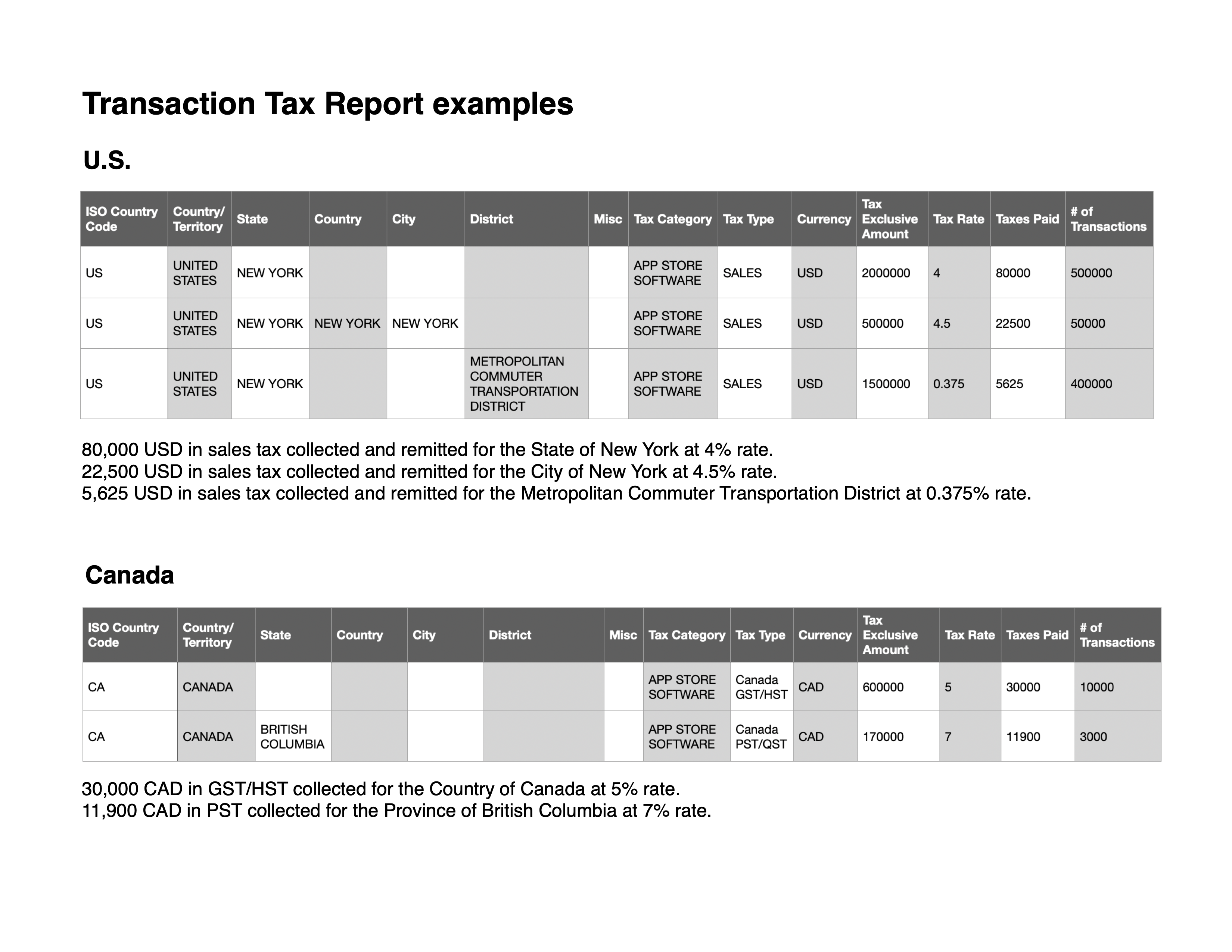

Sample transaction tax report

|

Field title |

Description |

|---|---|

|

ISO Country Code |

Two-character ISO code for the country as determined by the customer's billing address. |

|

Country/Territory |

The country or region as determined by the customer’s billing address. |

|

State |

The state/province as determined by the customer’s billing address. |

|

County |

The county as determined by the customer’s billing address. |

|

City |

The city as determined by the customer’s billing address. |

|

District |

The district as determined by the customer’s billing address. |

|

Misc |

Additional customer billing address information relevant for taxation (e.g. Texas transit district, Colorado local improvement district). |

|

Tax Category |

The tax category is used to determine the tax rate for your app in each tax jurisdiction. |

|

Tax Type |

The type of transaction tax (e.g. sales tax, use tax, goods and services tax, and other similar taxes). |

|

Currency |

Three-character ISO code for the currency type paid by the customer. For example, USD for United States Dollar. |

|

Tax Exclusive Amount |

The amount of customer sales taxed at a given rate minus the tax amount reflected in the Taxes Paid column. |

|

Tax Rate |

The tax rate applied to these transactions. |

|

Taxes Paid |

The total transaction tax (sales tax, use tax, goods and services tax, and other similar taxes) amount per tax rate in the customer currency for these transactions. |

|

# of Transactions |

The number of transactions taxed at a given rate in each jurisdiction. Note that this only includes transactions without a corresponding refund. |